The Living Revocable Trust

NEW: See also REPLACE PROBATE

Florida residents whose living revocable trust was created some years ago, may wish to have it reviewed and possibly updated. Persons who have moved to Florida and brought with them a trust prepared in another state can have it reviewed by an estate planning attorney in Florida.

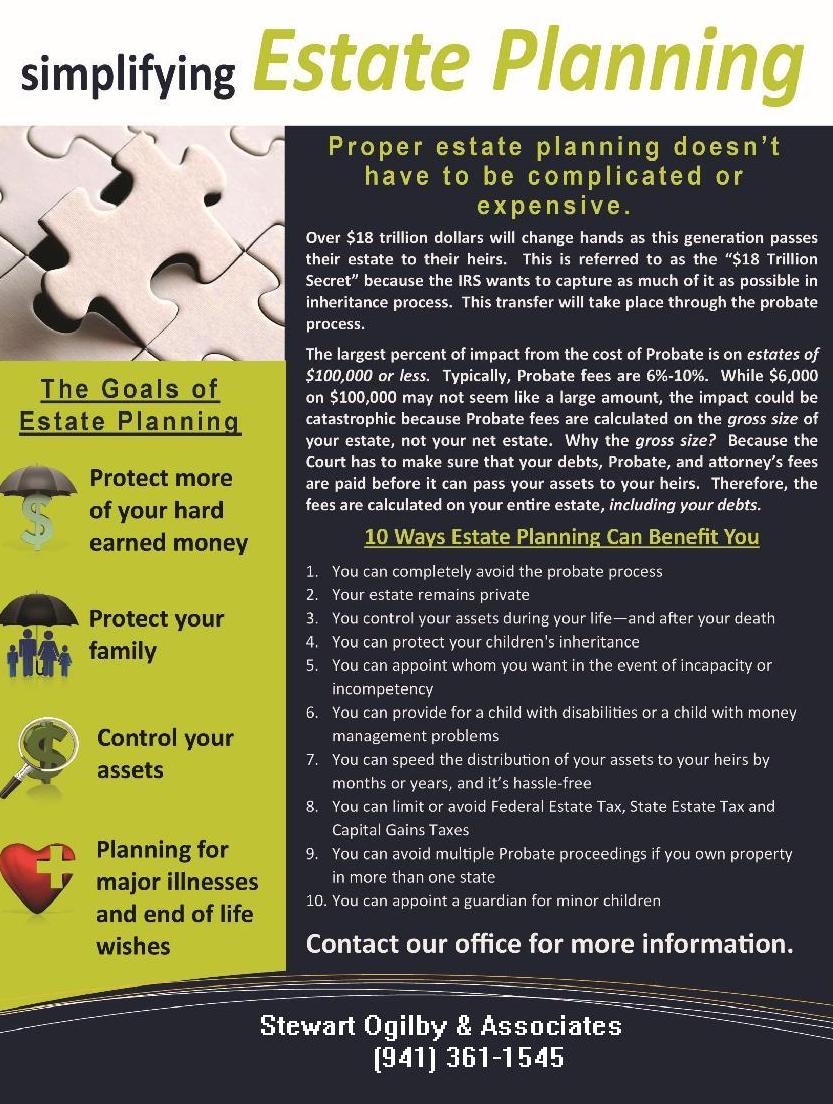

Persons often make the mistake of thinking that their own worth is not sufficient to warrant a living revocable trust. That is generally inaccurate. As is written below, The largest percent of the impact from the cost of Probate is on estates of $100,000 or less.

We can refer you to an attorney who is licensed to practice law in Florida and who specializes in estate planning. If you live in a state other than Florida and need an estate planning attorney, we may be able to refer you to one or more in your own state.

The estate worth one million dollars of a person who prepared a written Last Will and Testament, and who dies, must end up in probate court. By law, a will goes to probate and is subject to what is called “proving the will”. Probate is an expensive process. In the case of only a one-million-dollar “death estate,” the cost of probate might be in the area of $50,000 to $60,000, including legal fees.

Rather than using a written will to accurately distribute one’s estate, you may be surprised to be told, by an estate planning attorney, that the same result can be served well by means of a Living Revocable Trust that by-passes the probate process, saving the estate (and one’s beneficiaries) legal fees and most of that $60,000. Unsurprisingly, certain lawyers much prefer the probate process.

Just as it is advisable to seek the help of an attorney when drafting a will, it is hugely important to have the help of an attorney whose practice specializes in estate planning when drafting and legally executing a Living Revocable Trust that, itself, will not end up in probate court where lawyers may benefit from not only probate fees but trust administration fees as well.

Over the years of working with families and attorneys, we have seen huge mistakes made. They included trusts that may have cost less but were destined for probate, and many trusts that were valueless due to being unfunded or that were funded improperly.

We do not like to speculate on the motives of members of the legal profession whose incomes result from huge probate fees earned as a result of writing wills that wind up in probate courts. Ralph Nader (himself a lawyer) described probate as “the screwing of the average corpse.”

The legal cost for a properly prepared LRT pales in comparison to its value in estate savings, privacy, and the burdensome work saved that is otherwise demanded from the executor of an estate in probate. Read “The Living Trust” by the late Henry W. Abts, a remarkable man with whom we associated for a number of years.

8470 Enterprise Circle

Suite 110

Lakewood Ranch, FL 34202

Email: Have Questions?

Office: (941) 361-1545